This is a transcript of a live webinar. Please download supplemental course materials here.

Craig Castelli: I am pleased to be back with AudiologyOnline this year. This week we publicly announced our launch of Caber Hill, which is a rebranding of Bridge Ventures. Since 2010, our firm has worked primarily with audiology practices, and that is something we look forward to continuing for many years to come.

Today we are going to talk about exit strategy. I look at exit strategy as the plan for your business, not only for the sale but also for the events that lead up to the sale. This concept of treating your practice like an investment is born out of the different tools and experiences we have had selling businesses over the years, and things we have seen that make some practices succeed or struggle when selling.

First, let’s consider some of the things that you tend to associate with the sale of your business. Most business owners think of the financial aspects. “We want to sell our company for a fortune.” Many of you probably have a number in mind. “If I can get this amount, then I am happy to sell,” or, “This is what I think the practice is worth.” You probably also think about retirement and moving on to the next stage in your life. For those of you who are bit more entrepreneurial, you tend to think about your next investment or the next business you are going to own. Either way, the sale of your business is going to finance these goals and make them possible. The unfortunate reality, however, is that 80% of business owners in the United States fail when trying to sell their company. This is an alarming statistic, and I have intentionally placed it at the front of this presentation to serve as a bit of a wake-up call. I know far too many people who think they can wake up one morning, decide to sell their business, and go out and do it. In reality, that does not exactly happen.

I do not blame some of you who are looking at this statistic and think there is no way it can be true or that it in no way applies to you. I did not believe it when I first saw it either, but this is a statistic that has held constant for the past three to four decades. It has been studied by numerous organizations, trade associations, publications and independent firms, and regardless of the year, the economic climate, or the source of data, they all return roughly the same statistic: only 20% of businesses listed for sale in any one year will sell.

I measure success when selling a business in three ways. First, I look at if the business actually sells, and if so, how long does it take? It should take you about a year to sell your business. The average time in the United States is nine months. I find that it is rare for something to take exactly 9 months, but we typically see a range from 6 to 12 months being the normal and reasonable amount of time it should take to sell your business. If it takes you much longer than a year, something is wrong.

The second point is the price. Does the business sell at or near the asking price, and/or does it sell at or near the fair market value of the business? If it sells for considerably less and you are virtually giving the business away, that is not a sign of success. Lastly, I look at the satisfaction of the owner after the sale and I tend to find, unsurprisingly, that if the business sells in a reasonable period of time at or near the owner’s expectation then they are pretty happy.

We look at these 80% that do not sell and may deem them failures. It does not mean that they never sell, but they tend to take much longer, with a two-, three-, or four-year process to get the business sold, during which time the owner likely lowers the price considerably. It could be that they were asking too much to begin with. It could also be that there were other factors that harmed the value of the business, and it ended up being worth less than the average business in that industry of a comparable size and position. The goal here today is to share with you some tools and concepts that can help you and your practice be one of the 20% that succeed.

I have identified four take away points for today. First, it is never too early for an exit strategy. Second, we will talk about how to think objectively about your practice and take the point of view of a buyer who is analyzing your practice from the outside. Third, we will talk about some of the primary risk factors that exist in audiology practices and how to implement turnkey practices to make your business more attractive. Finally, we will talk about how to determine the right time to sell. I know that it is a question on many people’s minds.

Throughout the presentation, we will continue to refer to this theme of how to treat your practice like an investment. In order to do that, let’s look at the word investment. An investment is an asset purchased with the idea that the asset will provide income in the future or appreciate and be sold at a higher price. Think of a stock. If you buy stock today, it is going to provide you with some dividends over a set schedule, and then at some point you are going to sell the stock, hopefully for more than you paid for it. It generates income for you annually, as well as over time.

Investment vs. Career

Let’s compare the word investment to the word career. A career is an occupation or profession, especially one requiring special training and followed as one’s life work. Many of you went into the field of audiology because it was something that you were passionate about. You wanted to help people. You enjoyed the science behind it. This was your chosen career. At some point along the way, you decided that private practice was the right next step for you, and you made the move from employee and audiologist to business owner and audiologist.

The words investment and career are not normally compared and contrasted against each other, but in this case it makes a lot of sense. Many business owners fall into the trap of running the business only to support their own personal lifestyle. You go into private practice because you can pay yourself a higher salary, and perhaps you can take some more time off. You certainly have the autonomy and the flexibility to do whatever you want, more so than you did when you were working for someone else.

When you have a career, it still generates an annual income for you, but there is no gain over the long term. To put it simply, you retire from a career but you exit an investment. Think about these two concepts. Retiring is highly personal. It is an event for celebration. It is a big milestone, but it is simply a personal decision that lacks the financial pay-off realized when you exit an investment. Exiting is something that is highly strategic. There is usually a gain attached to it. It is a very financial situation.

These are two very different mindsets. Business owners tend to fall into one of two categories: those that view their business as an investment and are constantly taking measures in order to improve the value of that investment, and those who simply view it as a career and let the business support their lifestyle, but never truly thinking about the long-term gain or the bigger picture.

It is Never too Early for an Exit Strategy

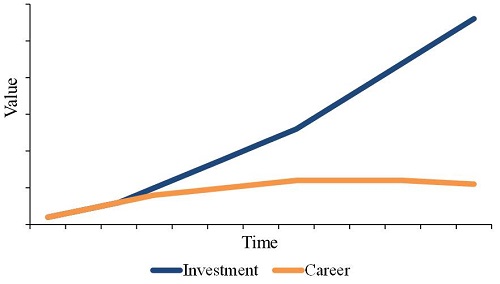

With that said, let’s move into our first topic: It is never too early for an exit strategy. Figure 1 shows a chart that plots the value of a practice over time. We have plotted two practices in Figure 1: the practice treated like an investment and the practice treated like a career. For the first couple of years, the practice is going to grow. If you start something from scratch, you are starting with 0. If you make it to year two, you had to have grown somewhat. Most likely you are going to grow more in year two than you did in year one, and more in year three than year two. If you buy a practice, you are also going to experience some growth over the first couple of years. It may not necessarily be revenue or sales growth, but you will find that when you first buy the practice, you are going to be very conservative. You are probably still paying down a loan, so you cannot pay yourself as much of a salary or bonus. You are also afraid to take too much cash out of the business. You do not want to be strapped for cash and in a bind your first couple of years. Then, as you become more comfortable and pay off your loan, you are able to give yourself a raise and take more cash out of the business, benefitting from the growth of the practice’s bottom line.

Figure 1. The time value of an investment versus a career.

After the first couple of years, the two paths begin to diverge (Figure 1). We see that career-minded owner continues to grow their business, but the growth is slow. Most likely it is in line with industry growth. When you reach a certain point in the future, this growth tends to plateau. At this point, the owner has become comfortable. Their house is paid off, perhaps they have bought a second home or boat, children’s private school tuitions are paid for; when you reach this point you know exactly what you need to do in order to continue to generate just enough income to cover all those expenses. Your life is great; you are happy, so you are not focused on growth. Towards the end, we start to see the growth start to taper off a little bit (Figure 1). Perhaps you are working a little bit less; you have gotten too comfortable and you have saved enough that you do not necessarily care as much about growth.

Compare this to the business treated like an investment, and when these two paths diverge we see the growth occur at a much more rapid rate in the investment practice; where the career-minded business plateaus, growth actually accelerates for the investment-minded business owner. Why is this? The investment-minded business owner, instead of taking every penny out of the business to fund their personal goals and operating the business for the sole purpose of supporting their lifestyle, is constantly reinvesting in the business, whether it is improving procedures and systems, investing in expansion, hiring more people or creating improved marketing tools. They are constantly focused on how to grow the business. When we get to the end, the terminal value of the investment-minded business is several times larger than that of the career-driven business. It is not to say that the career-driven business cannot be sold, but it tends to be much harder to sell, and it certainly sells for a discount compared to the investment-driven business.

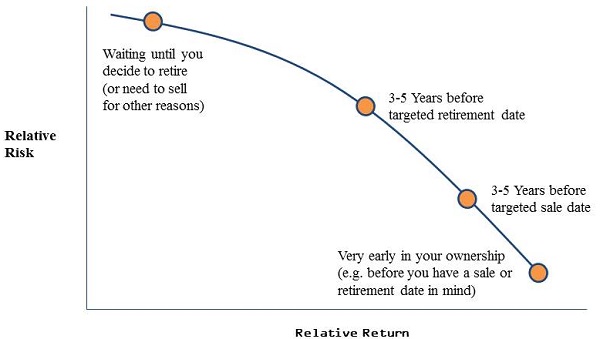

When we talk about the fact that it is never too early for an exit strategy, I like to frame it in terms of risk and reward. For the most part, any business can be sold at a certain price over a certain period of time. How easy that is and how much you sell it for are the key factors that are tough to gauge; planning for the exit will help ensure that the return is greater and the time to sell and the risk involved are bothless. Typically, your risk/reward profile goes from bottom-left to top-right. The greater the risk, the greater potential for reward. In this case, we are looking at it from the opposite point of view (Figure 2). At the top left, we look at the business owner who waits until they are ready to retire to start thinking about the exit. They wake up one morning and say they want to retire next year so they better get ready to sell this thing. That is the riskiest situation in which you can find yourself. It is less likely that you will find a buyer right away, if at all. You certainly raise the risk of having to sell it at a significant discount and reduce the return that you are going to receive from the sale. Retirement is not the only event that can cause this situation. Imagine if a sudden illness or other type of financial hardship or divorce compels you to sell. You have no choice. You have to sell, and you are not prepared. At that point, you are probably giving the business away or finding yourself unable to sell it altogether.

Figure 2. Exit planning: risk/reward profile.

Moving into the less risky categories (Figure 2), we see that the middle two dots are three to five years before the targeted retirement date and three to five years before the targeted sale date. I make the distinction between three to five years before retirement and three to five years before selling because selling does not always mean retiring, and that is especially the case in this industry. It is common for practice owners to stay on and continue to run their practice for the new owner for a period of time after the sale. Most often, it is about a three-year time period, and this happens for a few reasons.

Sometimes we will find owners who say they love being an audiologist and love seeing their patients and doing this work on a daily basis, but they hate being the business owner with the stresses inherent at running the business. In other cases, they do not have a choice. A buyer is coming in who is willing to pay a considerable premium for the business, but does not have the means to operate it. They are not an audiologist themselves, and they need an audiologist in there. If you are an owner who is heavily involved in seeing patients on a daily basis, then they need you to stick around in order to continue running the business for them; otherwise they simply cannot buy it. That is why it is much less risky to start planning for three to five years before the targeted sale date then the targeted retirement date.

Think about five years before a target retirement date and work backwards from there. If you are working for someone for three years and then you take a year to sell the business, it really only gives you a year to prepare. However, three to five years before your sale date is a good amount of time in order to correct any areas of the business that need to be improved upon in order to increase your value and make it more likely to sell.

Finally, very early in your ownership, before you even have a sale or retirement date in mind, begin implementing some of the processes and tools that we will discuss throughout this presentation. It will put you in a much better position for a lucrative exit, and it also enables you to capitalize on opportunity. You may not necessarily be of retirement age, but say that you find that the market conditions are appropriate to sell the business and realize that the market conditions at that point in time will allow you to sell for more than you will in the future I the business is ready to be sold then you can take advantage of favorable market conditions; if it is not, then it becomes considerably more difficult.

Think Objectively about your Practice

Let’s get a little more specific. The first topic we will discuss is how to think objectively about your practice. I have one more term to introduce: self-serving bias. The self-serving bias is a person’s tendency to attribute positive events to their own character, but attribute negative events to external factors. It is a psychological term. If it goes well, it is because of what I did. If it goes poorly, it is your fault. Some examples of the self-serving bias are getting an A on a test and attributing it to your own awesomeness, then getting a C on a test and attributing it to your professor not having explained what they wanted well enough. I failed, but it is your fault. Most men rank themselves in the top half of male athletic ability. This is statistically impossible. Ask a married couple to each write down their individual contributions to household work and the total almost always exceeds 100%. I am pretty sure my wife and I have had conversations where it has exceeded 200%. This last one may hit a little closer to home. When my business grows, it is because I am such as great business owner. When it declines, it must be due to the economy.

If we were all in the same room, I would ask for a show of hands of those who have never once blamed the economy for the performance of their business. Chances are, no one is going to raise their hands. I understand that we had a financial crisis in 2008. I am not insensitive to the fact that economic factors do contribute to business performance; however, I still hear that excuse today. In 2013-2014, our economy has been growing for a few years straight. Our stock market has been on fire. The hearing aid industry has been growing, and I see several competitive practices in the same market that are producing growth rates well above the industry average, yet this practice that is flat or declining is claiming that it is the fault of the economy. That is, the owner is saying that the decline is completely driven by external factors. We need to get over that as business owners and start to look internally in order to find what is driving our successes and shortcomings in order to understand our business and determine what will take it to the next level, as well as what we can do to prepare our own exit strategies.

Another example of how this comes into play is in the perceived value of the practice. When we talk about valuations, we almost always discuss valuation as a range. You receive a valuation report, and it is normally going to result in a single number. But in reality, there are several numbers that can apply, and there is always a range. That can be driven by the valuation method that is used, and the assessment of value should always entail several valuation methods so you have a more representative sample. It also will depend on who is buying the practice. Certain buyers are willing to pay higher prices than others. It also depends on the terms of the transaction. There are certain things to which you can agree that will result in a higher price. However, if you decide there is no way you want to go along with such terms, there is a chance the price is reduced. We do find that there is a fair market value range for every practice. That is truth.

Every single business has a fair market value. Most owners’ perception of the value of their practice is considerably higher than the fair market value range. Why is that? It is their own bias towards themselves, whether it is driven by rumors that we have heard in comparing ourselves against someone else’s business - “He sold for X, and I am a much better business owner than him, so I must be worth more” - or, it is just pure blue-sky scenarios, thinking about how great we are as individuals and as business owners. Fortunately, most of the time, there is this overlap. If you can find the sweet spot where your value and the market value coincide, then you are likely to succeed in selling the business.

Why am I talking about the perceptions in value and the fact that many owners think their practice is worth more than it is? The number one reason companies do not sell is that the seller has unrealistic expectations. Think back to the statistic that only 20% of businesses listed for sale at any one time actually sell and 80% do not. Why do most of those 80% not sell? A huge factor is that they are priced incorrectly. When you put your business on the market with an inflated asking price, you are sending a signal. The signal that you send to potential buyers is, “I am not serious about this sale. I do not have realistic expectations.” Buyers perceive that it is highly unlikely that a deal is going to get done. Many will not pick up the phone and call you or respond to your ad because they are going to assume that it will be impossible to get a deal done, based on the signals sent by the asking price.

Think about investment-minded owners versus career-minded owners. Owners treating their practice like an investment take steps to better understand the company’s value at an early stage in their ownership. They do not wait until they are ready to sell. Why? First of all, you can better align your expectations with reality so that when you do sell, you can price the business properly for sale. It also allows for you to prepare. It is like the first point on a map. You know where you want to be. You look at the map, you see where you are today. If you like the number, then you can sell it now. If you do not like the valuation, there is an opportunity to dig in and figure out why the valuation is what it is, what you can do to improve it, and whether it is an issue of growing the sales or profits or improving internal operating factors of the business to make it more attractive for when you do sell. At that point, you can sell at a price that aligns with your goals.

The career-minded owner does not do that. This person does not take the steps to understand their value. They base valuation expectations on rumors, blue-sky scenarios, sticking their finger in the air and seeing which way the wind blows. They are the ones who are more likely to overprice the business when they are listing it for sale, and they have a harder time selling it. The price should be based on fair market value. Fair market value really is that; it is the amount for which the business should be sold, based on other companies in the industry and traditional valuation methods. When we look at owner expectations being higher and the market values being lower, we are not suggesting that the market is undervaluing these businesses or that you are accepting low ball offers; we are suggesting that it makes sense for everyone to gain an objective sense of what the business is worth before attempting to put it on the market.

Take a Buyer’s Perspective

Once you understand what the business is worth and you start to think about the business objectively, the next step is to dig into the buyer’s perspective and start thinking about your business from the buyer’s point of view. Sellers and buyers have very different perspectives when they analzye a business. The first thing most business owners think about their own practice is how much it has done for their lifestyle. It was the greatest move they ever made. It afforded them all this all this flexibility. They improved their earnings.

Another thing that sellers talk about quite a bit is potential. “This business has so much growth potential. I know I have not grown it that much, but a new owner can easily do X, Y, and Z, and that will grow the business.” You think about your patients and the rapport you have with them. Your community, your reputation, and all these soft, intangible factors mean a ton to you. But it is not what the buyers are looking at. Buyers are boiling this down to two things. Can I make money owning this, and how much risk is inherent with owning the business? There is risk inherent in any investment or business, but how is that mitigated so that they can make money? They still care about some of these intangible factors, but they want a business that has a great reputation in the community; however, that alone does not improve the value. If the business has a bad reputation, they are simply not going to buy it. If the business has a good reputation, it is one more reason to buy it at the value they have already established. The same thing goes for growth potential.

I hear about growth potential all the time. Almost every single practice with which we work talks about the potential they have and all the things the new owner can do. The fact of the matter is that does not influence the value of the practice. It can influence the buy or not-buy decisions. If you are not realizing the growth potential, then a new owner has to come in, and they have to make the investment required to realize this potential. They have to take all the risk required in order to grow the business. Therefore, they are the ones who are entitled to reap the rewards. When you start approaching the sale, think about the potential in a practical manner. Think about why you have not realized that potential before you start to tell a new owner how easy it will be for them to realize that potential.

I think the most important thing you can do when you start to assess your practice and try to take a buyer’s perspective is to think about if you were expanding. What if you were going out and looking at another business to buy? What are the things you would look at? Chances are, that is what a buyer is going to look at in your practice.

The first things that come to mind are the finances: cash flow and return on investment. Is the business profitable? How big of a loan can I take out and still have the loan payments covered by the cash flow of the business? Is this business growing? Are revenue and cash flow growing? A growing business is always more attractive than a business that is flat and obviously more attractive than one that is declining.

The next thing is to look at staffing. Is the owner of this practice a major revenue producer? If so, how do you replace them when they retire? Are there other staff in place? Who are they, and are they willing to stay post-acquisition? Am I buying a business that is ready to operate from day one with staff in place, or do I have to go out and find all new staff? They look at the ease of operations. What is in place today that is making this business go? Is your marketing well planned? Is it documented? Is it easy to replicate, or is it all in your head and you are making things up on the fly? “Business is great, so I am not going to market. Business gets slow, so I’m going to start marketing again.”

They will look at the policies and procedures for the business. Are they documented? This includes general sales and patient-related policies, return policies, refunds, the various services that may or may not be included with the purchase of a hearing aid. It also includes policies for managing your people and managing your business, such as the staff, how they are paid, and what they do. Is all of this documented? Is there a handbook that you can hand over to them, or is it all in your head?

How stable are the employees? Have they been there for several years? Do they know the ins and outs of the business or do you experience high turnover? If you were buying another practice, these would be important factors to you as you assess whether or not it was going to be a good fit for you and the existing business you have. Buyers are going to look at your practice the exact same way.

Finally, they are going to take a look at risk. How risky is this investment? What happens when the owner leaves? Are you reliant on specific third-party payers or specific referral sources that are a major concentration point of your business, or is your business pretty diverse? Do you have patients and sales coming from a variety of channels? When we talk about the investment-minded owner versus the career-minded owner, the owner treating their practice like an investment understands the buyer’s perspectives. They have become comfortable with looking at their business objectively, viewing it through the lens of a potential buyer and balancing their personal goals with the buyer’s objectives, making sure they can answer these questions and position the business so that a buyer feels comfortable with what they are walking into. The career-minded owner ignores this. They focus only on their personal goals. They assume that a lot of these things do not apply to them, and, unfortunately, when they attempt to sell the business they answer many of these questions the wrong way. It can negatively impact their ability to sell the business at all.

Understand Risk & Turnkey Practices

Let’s talk about how to mitigate risk and make your practice more turnkey. There is risk inherent in any type of investment and in any type of ownership. There is employee risk. Your employees can leave, and you can have high turnover. They can underperform. They can steal from you. They could not show up. There is owner risk, where the business is tied directly to the owner and its performance is reliant upon the owner. There is financial risk. Like any investment, you can lose your money. There is legal risk. This is America. Anyone can sue anyone else for any reason at any time. There is payer risk. What happens if third-party payers change their reimbursement? How does that impact your business? We have economic risk. The economy can grow or shrink. We had a financial crisis that impacted several businesses. There is the risk of disruption. Disruptive technologies or disruptive delivery methods can render your service or your business model obsolete, or at least harm it substantially. Finally, there is referral risk tied to different referral sources of your business.

Of all these risk factors, there are many that apply to every business under the sun. There are three that apply specifically to about every single audiology practice that also happen to be under your control. There is not a whole lot you can do about economic risk or legal risk. You can, however, pay attention to owner risk, payer risk, and referral risk, and take steps to make sure these risk levels are low in your practice.

Owner Risk

One of the primary questions to ask of any business owner is, “What exactly are you selling?” You are going to sell the business, but what is it that you are fundamentally selling? You have your tangible assets, like equipment, inventory, and the furnished office space that is built out to be an audiology practice. You have your intangible assets which are the files, the business name, contracts, and business good will. Then you have your profits and losses (P&L). This business is going to generate revenue and cash flow in the future, and that is the primary driver of the value of the business. But even with all of that, we can still ask the question, “What are you selling?” or more appropriately for this section, “Does any of this have value without you?”

If you are not involved in the business, is there still a P&L? Is there still revenue coming in the door? Is the business still generating positive cash flow? Owner risk occurs when the owner is a key contributor to the practice. You are involved in seeing patients on a daily basis. You are generating a significant portion of the revenue. The risk is that when the owner leaves, revenue declines and patients leave. Typically, the owner is the most effective employee. You are going to have the best rapport with the patients. It is your name that is most likely going to be known, and if you are no longer there, it is very difficult to replace you with any other non-owner employee, because they are not going to have the same drive, passion, or connection to the business.

I am sure some of you listening are solo practitioners. It is you who sees all the patients and does everything else. Consider the impact that may have on your ability to sell, as well as on a new owner coming in, and how you can reduce that risk. The first option that is probably the most obvious, but also the hardest to execute, is to move out of a direct patient care role. You find a way to replace yourself with another audiologist, whether it is bringing someone in to replace you outright, or growing by adding new employees. You build the business to a certain point where you are at capacity for the number of patients that you can see, the amount of revenue you can generate. You bring in a second audiologist to help see more patients and grow the business and all of sudden, you go from 100% of the revenue to 50% of the revenue. As the two of you each grow your respective shares, and you reach capacity, you bring in a third person. All of sudden you go from 100% to 50% to 30% of the revenue, and as you continue to generate less and less of the revenue, the business becomes less reliant on you. If you can get it below 20%, you are doing very well; considerably above average. If you can get it below 5% to 10%, then for all intents and purposes, owner risk does not exist.

That is not going to be possible for everyone. It could be too late for you to expand in that fashion. You may not be in a market that can bear such expansion. You may not have the financial wherewithal to make that type of investment.

The other option is to agree to a very long transition period or a multi-year employment agreement to work for the new owner. This is fairly common. The most common term for someone to work for a new owner after they sell the business is three years, although this can vary. We have started to see some that are shorter and some that are longer, but most of the time it is three years. If you do something like this, owner risk is significantly reduced. You now have given this buyer a window where you are transitioning the business over to them, and they know things are going to operate as they always have for a certain period of time. If it is three years and the buyer cannot figure out a way to replace you over the course of those three years, at that point, it is on them and it is no longer your burden. You have done your part. You have reduced the risk and it makes your business considerably more sellable.

Payor Risk

The next area of risk is payor risk. This refers to third party payors, occurring when a company is over-reliant on the third party business. When we are doing a risk assessment here, we are going to look at both the type of payors and your payor concentration. Various types of payors are out there, including private pay, and they each come with different levels of risk. Medicaid is probably the most risky, because so many states are struggling financially. We have seen certain states over time cut reimbursement for hearing aids from Medicaid. Michigan is a prime example. Michigan, in the last 10 years, has cut and reinstated it at least 2 times, if not 3.

Next would be other government agencies. Again, the government agencies are the ones that are most likely to reduce reimbursement. The state of Indiana is a prime example of this one. They have a vocational rehabilitation program that used to be extremely lucrative. It was a competitive bid system. The patient sees one audiologist. A hearing aid is recommended. They submit a quote to the state. The state goes out and shops for a second quote of that same product. Whoever quotes the lower price wins the bid. That lower price could be $7,000 for a pair of premium hearing aids and the state would still reimburse 100% of that price as long as it was the lowest bid. Ultimately, the state learned that this was not the most effective way to run a system like this. They centralized all the billing. They now reimburse on a flat-fee basis. They slashed reimbursement dramatically, and practices that were relying heavily on vocational rehab patients suffered because their revenue was cut dramatically.

Then, less risky are private insurances and beyond that, we have private pay patients. The private pay patient is always the most ideal and is always the least risky.

When we look at the payor concentration, it is more than just the type of payor that you are working with. It is how much you are working with any one specific payor. If 100% of your business is third-party, it is very risky because every single patient that is coming in your door is subject to the various risk factors inherent with working with third parties. A little less risky is the situation where you have one third party that generates more than 25% of your revenue on its own. Here you may have a business that is working with multiple different payors and has some private pay business, but you have one chunk of 25% more of the revenue that comes from one single source. Just as with the previous example of vocational rehab, if something changes, perhaps the benefit is eliminated or the reimbursement is slashed, it has a dramatic impact on your revenue and your practice’s ability to continue to flourish.

Obviously 100% private pay is difficult to achieve, but that can be the optimal situation because it is one thing that is not subject to outside influences. It is just you and the patient and your ability to attract them into your office and fit them with the hearing aid that is appropriate for their hearing loss and their budget.

Referral Risk

The final type of risk is referral risk. Referral risk occurs when a company is overly reliant on referral sources or has a referral relationship that is non-compliant or difficult to continue after the transaction. Just as third-party payors can change or go away, so can referral sources. If your business is too reliant on a single referral source and something changes, your business suffers. The most obvious examples are some of the ENT relationships that I have seen audiologists establish, where an audiologist has opened a practice within the confines or right next door to an ENT practice, and relies extensively on referrals from the ENT, because the ENT does not employ their own audiologist. This is great while you are running a business. You do not have to do as much marketing. You can run leaner because you may share staff or facilities. You have a great relationship. You have a built-in referral stream. I have seen plenty of audiologists make plenty of money running their businesses this way.

The problem is that one day this ENT is going to retire, and that percentage of your business is gone the day he retires. This is very risky for a buyer because they need to make sure that the referral streams are going to continue for a considerable period of time into the future. Otherwise, they will be less interested in buying the business.

The next thing to look at is the contractual arrangement with your referral sources, whether it is the ENT or some other referral source. This refers more to you going in and setting up shop within someone’s office to do testing to sell hearing aids more so than just a primary care physician who you have sent a couple of letters and they send you a referral every once in a while. But if you are relying on this referral source to be a larger piece of your business, is it contractually agreed to or is it just a handshake agreement? If there is a contract in place, then they are obligated to rely only on you to provide their audiology services. Maybe you are renting space in their office and they have to send you that business. You have a better likelihood of continuing to receive that business in the future this way.

If you have a contract, the next question is, “Can it be assigned to the new owner of your business if you sell your business?” A new owner is going to want to know if the existing contract will apply to them or if the doctor can cut if off right away. They look at the possibility of losing that stream of income. If the contract is written in such a way that you have the rights to assign it to the new owner of the business, it facilitates a smooth hand-off of this relationship and severely mitigates the risk for the buyer.

Compliance

Finally we have the compliance issues. I am no attorney, so I am going to discuss this briefly. We have all likely taken courses on anti-kickback laws and Stark Laws. When you have these relationships, whether or not there are contracts in place, buyers are going to want to ensure that they are compliant with the various laws that govern such relationships.

Turnkey Practice

If we take the three risk factors (reliance on referral source, contract and compliance) and reduce all of them, we make the business a much more attractive investment, and this is first step to making the practice turnkey. What is a turnkey business? It means the new owner can begin operating on day one. Literally, all they have to do is turn the key in order to be up and running. Strategies, processes, and employees, are in place for them to hit the ground running the day they buy the business. When we say turnkey businesses, I like to think of franchises. I am not referring to Miracle Ear or some other hearing industry franchise, but let’s talk about it in an example to which most people can relate, which is a fast food restaurant like Subway.

Say you buy a Subway franchise. What do you have? The menu is already created. The pricing is already established. They have the sourcing relationships for you to get your ingredients delivered on time. They have already designed the layout of the restaurant. You have your color schemes and your logo. They have national advertising. They have employee manuals, operating manuals, and all of the systems and tools in place for you to come in on day one and run the business. As the local owner, all you have to do is find, hire, and retain employees, manage some local marketing, and manage your own books on your local level. I am not saying that it is easy to run a Subway franchise, but it is much easier for you to get off the ground with a Subway franchise than another restaurant that you start from scratch. As many of you know, restaurants have one of the highest failure rates of all new businesses, and franchises have lower failure rates than other restaurants simply because of these turn-key procedures and policies that have been put in place.

How do you build a turnkey business in audiology? Our risk factors are already low. The business is no longer reliant exclusively on the owner, so it is easier for a new person to come in and take over. Some of the things we look at are whether or not you have an accounting system in place. Something simple like QuickBooks or one of the newer cloud-based accounting systems goes a long way to help you run reports. It helps you to provide a snapshot of your business’s financial performance at any point in time. I think most practices at this point have QuickBooks.

Do you also know how to use it? Can you train a new owner how to use it? Can you run reports to show different financial metrics on a per-office or per-employee level? Many practices have practice management systems, but I still know many that do not. Having a system in place allows you to have a better understanding of your business today. It allows you to present the business in a more professional light to a potential new owner. Chances are good that the new owner is going to want a practice management system in place when they come in. If you already have it there, it is one less thing they have to purchase and set up after they buy the business. Therefore, it makes your practice more valuable.

In terms of human resources, do you have an employee manual that documents what each person does, what their roles and responsibilities are, and how they are paid? Do you have policies such as vacation and personal time off, sick days, and benefits? You may know those policies in your head, but do you have something in writing that a new owner can come in and read, understand how it works, implement it and live it from day one? Is the business profitable and growing? As I mentioned before, it is much easier to sell a profitable business and a growing business than one that is the opposite.

Again, let’s look at the comparison between investment and career. The investment-minded owner takes measures to make the practice turnkey, understanding that there is a short-term gain that they are going to be able to run the business more effectively and the long-term gain of making the business more sellable, whereas the career-minded owner just sticks their head in the sand. I know I am not the first person to make some of these recommendations to you. You hear all the time of the benefit of practice management systems, but there is a reason why some people invest in them and use them, and ultimately benefit from them, and others do not. The career-minded owner is more willing to put this off, thinking it is not that big of a deal, and that they will still be able to sell their business with or without those things.

Determining the Right Time to Sell

We often get the question, “When is a good time to sell?” I look at timing in three ways. There is personal timing. Personal timing is when it makes the most sense for you, independent of the business; this can be when you are ready to retire. There is company timing. Is your company growing and profitable? Is risk low? Have these turnkey practices been implemented? We also look at market timing. Is the industry hot? Are there buyers? How are the tax rates and how are you going to be taxed on the sale? What are interest rates, and is it easy for a potential buyer to get a loan? Are interest rates low, affording them the ability to pay a higher price for the business?

Most of the time, we find that people are targeting the sale date based on personal timing. Unfortunately, that is the least important factor when deciding to sell. Company timing and market timing will dictate the value of your business. Just because you want to retire does not mean that there are going to be buyers out there. Just because you want to retire does not mean that your business is all of a sudden going to grow or become less risky. This becomes a balance. Exit planning can revolve around a retirement date. You can sit down and say you want to retire in 10 years, and then you can begin to make the changes and take the necessary steps to turn your practice from a career into an investment. Grow it the right way, make it turnkey, reduce risk, and then you can drive the company timing to coincide with your personal timing. Market timing is tougher to predict. It is a great time to sell a practice today. It looks like it should be for the next couple of years. No one knows what is going to happen in 5 to 10 years, so I am not going to venture to guess. At the very least, you can have some level of control over the company timing.

That is what the investment-minded owner does. I think it was obvious that this was coming at this point, but the investment-minded owner focuses on company and market timing, whereas the career-minded owner simply focuses on personal timing. They wake up one morning and decide they want to retire. They raise their hand and say, “I’m for sale,” with no prior planning having gone into it.

I hope that over the course of the last hour, you have come to understand why it is never too early to consider your exit strategy, how to think a little more objectively about your practice, what some of the key risk factors are, when is a good time to sell and not sell, and ultimately, how to treat your practice like an investment.

Cite this content as:

Castelli, C. (2014, April). Exit strategy: How to treat your practice like an investment. AudiologyOnline, Article 12627. Retrieved from: https://www.audiologyonline.com