This is a transcript of a live webinar on AudiologyOnline. Download supplemental course materials.

The topic of my one-hour presentation is Introduction to Strategy and Design in Audiology. It is a bit of an unusual topic for most clinical audiologists; nevertheless, I think it is an important one. My main objective today is to provide you with a bank of questions that you and your team can consider as you devise a strategy for your own practice and target a certain segment of patients out there. Times are changing, especially in healthcare, and the more carefully you can craft and execute a strategy and design your clinic to attract a certain core group of patients, the more successful your practice will be in the long run. I also want to point out that over the last three or four months, I have taken on the role of a reporter in putting this webinar together. I have interviewed a few CEOs, I have taken a couple of short business courses and read some textbooks, and I am hopeful that that information will be useful to you.

On your Business vs. In your Business

The first concept I want to get across is that there is a large difference between working on your practice and working in your practice. Most of us are trained that when we are in school taking courses, it is preparing us to work in our practice, but we do not get a lot of insight or develop skills around what we need to be working on to develop our business. Today, rather than working in our business, we are going to be working on our business. A lot of that is about asking the right questions. If we can ask the right questions and then put our heads together with our teams, we can oftentimes come up with the correct answers through the debate process. If you know anything about the ancient Greeks, this is called the Socratic teaching method. What I am hoping to do today is give you a bank of what I think are some of the right questions to ask when it comes to creating a strategy, implementing the strategy, and then designing a clinic to attract a certain core segment of patients.

My first question today is, “What is a sustainable business?” The keyword here is sustainable. It is one thing to be in practice today, but it is a completely different thing to be in practice a decade from now. How do we create sustainability? As you will learn, a lot of it has to do with strategy and design, but a very simple definition of a sustainable business is generating enough revenue to cover your costs so that there is some profit; that profit can be used to reinvest and expand your business or your practice. In my mind, a marginal profit is the path to sustainability. Strategy and design are a core part of that.

I think that the role of the hearing healthcare provider is very deeply tied to the devices and to the equipment that we use. This is my opinion, but I think that is a key problem. The cost of that technology is very soon going to be approaching minimal or near zero. In a lot of ways, that is an unsustainable business model if we tie too much of what we do into the devices and diagnostic equipment that we use. It is up to us as a profession to adapt, and if we do not adapt and try to change our business model, we are at risk for becoming irrelevant or obsolete. What I want to impart to everyone is that looking at our strategy differently, looking at different segments of the market, and looking at different channels can open up a lot of avenues as we try to create this path towards a more successful practice, especially in this age of disruptive innovations. As I have already said, I think a big part of this is strategy and design. Those two concepts are the foundation for how we build a sustainable business now and moving into the future.

Over the next hour or so, we are going to talk about channels and brands, and that is the core of what you need to devise your strategy. We will talk about strategy itself and what choices and actions we need to make in order to generate enough revenue to cover our costs and make a marginal profit. Then we will talk about design, which is the way your office or your clinic looks, and what we need to do to make that appealing to customers. Those are the three core areas of my agenda today. We do not have time to get into the nitty-gritty details of strategy and design, but my hope is that I can give you a good group of questions that you can use to dive into strategy and design with your own team or staff at your clinic. That is the “what’s in it for me.” I am hoping to give you the right questions so that you can implement your strategy based on some data that you will have to collect on your own. I hope to certainly point you in the right direction.

Three Trends in Healthcare

Creative Destruction of Healthcare

I wanted to give you a frame of reference for why strategy and design are so important today. I think that there are a lot of things changing in healthcare, and the better we understand that, the more likely we are to take the right course of action. I will talk about three different trends and how they relate to what we do in audiology.

The first trend is something called the creative destruction of healthcare. There is a great book on the market right now. It is called the Creative Destruction of Medicine (Topol, 2012). It is by a cardiologist by the name of Eric Topol, and I am going to borrow some of his insights today. If you look at the old healthcare model that is evolving and changing very quickly these days, it is very provider-centric and paternalistic, where the patient takes a relatively passive role in the delivery of healthcare services. It is very procedure-based, meaning that physicians and other medical professionals are oftentimes reimbursed on procedure rather than outcome, and it is a very top-down type of system. “I’m the medical expert. I’m the authority, and you, the passive patient, need to listen to what I say.” That is the old healthcare model that has been around for about a century now, for a number of reasons.

That old model is being replaced by a new delivery system. Dr. Topol (2012) calls this the super convergence of a number of factors: social networking capabilities, mobile connectivity and bandwidth, wireless sensors, imaging, low-cost data management systems, genomics, Internet, et cetera. All those factors are converging, and that is leading to the creative destruction of healthcare and changing the old delivery model into this new one that is based on many of those technologies. We are seeing that in a lot of areas of healthcare at this point, and I think audiology is on the outer edges of being touched by those technology innovations.

The Healthy Aging Movement

The second trend is epitomized well by the actress Florence Henderson who played Mrs. Brady on the television show The Brady Bunch. She is now about 80 years old and if you’ve seen recent photos of her, you’ll see she looks much younger than that. We call this the “healthy aging movement.” The healthy aging movement is more of a descriptive term than what we have been using: baby boomer. My definition of a healthy ager is someone who wants to live to be over 100 in the mind and in the body of someone who is 45. A growing number of patients are doing everything they can to maintain a healthy lifestyle. Here is the interesting thing about healthy agers. The death rate for infectious diseases has decreased dramatically over time a 100-year period of time (Christensen, 2008). I think this is why healthy agers approach the marketplace differently than previous generations.

In 1900 to about 1920, the death rate due to infectious disease dropped from 800 per 100,000 to about 400. It was cut in half mainly because of things like the chlorination of water, which cut down on a lot of common infectious diseases that caused mortality. With the exception of a spike in 1918 from an influenza outbreak around the world, for the most part, the death rate declined. Healthy agers are different than previous generations that we see in our clinics because of the use of vaccinations and antibiotics. That generation, for the first time in history, was not touched by infectious diseases. If you talk to your patients that are over the age of 85 or 90, it is very common to find that they have experienced a death of a sibling or a cousin at a young age for a reason that is virtually nonexistent for patients born after 1940 or 1945. This changes the mindset of people born after 1945. They expect to live longer, healthier lives, and that changes the way they approach the market, especially for services like ours.

There is data around this healthy aging movement (Wallhagen, 2009). Patients are much more likely to want immediate gratification from the services that are delivered to them. They are more informed, more empowered than ever before, and that puts a tremendous pressure and burden on people like us to deliver to their expectations.

Transparency of Results

The last trend revolves around low-cost video cameras that seem to be everywhere these days. We know that smart phones have video cameras, and more than 120 million Americans now have those. That number is expected to grow. We also know that there are about 30 million surveillance cameras out there. That means that almost everything we do today is transparent and is available for other people to view on the Internet and through their smart phones. That being said, we have to raise the level of our delivery model and skill that we provide, because everyone is now judging our work and looking over our shoulders. People can go to sites like Yelp and Health Grades to read critiques from other customers and patients. The end result is that it puts an additional burden on us to make sure that we deliver outstanding, high-quality results.

What do these three trends mean? They mean that in the face of creative destruction and innovative technologies, it is all about our ability to individualize and customize all points of the service delivery interaction with patients. We will talk about differentiation strategies in a moment. The more we can tailor and individualize our services, the more likely we are to create value. But the real question is, “What segment of the market finds that value proposition appealing?” Not every segment of the hearing-impaired market values customized individualized services, as we will learn. It is up to your practice to try to identify what segment of the market wants those types of services. That is what strategy is all about.

Channels and Brands

Let’s continue on the path of talking about channels and brands. We are going to talk about brand first, because this forms the core of your strategy. The question I want to look at is, “How do you define your brand?” It always helps to start with the definition. Brand is one of those words that we know what it is, but it is oftentimes difficult to articulate. One of the better definitions of brand that I have seen comes from Seth Godin, who is a fairly well-known marketer. His most well-known book is one written about 10 years ago called Purple Cow (Godin, 2003). He says the brand is a set of expectations, memories, stories, and relationships that, when taken together, account for a customer's decision to choose one product or service, hopefully yours, over another. If the customer is not paying a premium or they are not deciding to do business with you, then that customer does not value your brand. I think that forms a good definition of what a brand is, and it revolves around how a customer perceives you.

Here is the core question that I think everyone ought to ask themselves before even formulating a strategy. “What do you want your practice to be known for?” The answer to this question gets at what your brand is, what you want it to be, or how you want to be perceived by the market. I can tell you there are only a few possible answers. There is no wrong answer, but the five answers from which I know you can choose are to be known for low prices, which is how Walmart has formulated their brand strategy. Second, you could be known for convenience, which is how McDonald's and other fast food chains have formulated their brand strategy. You could be known for having the most innovative technology, which is the path that companies like Apple have chosen. You could be known for delivering the most personalized customer service, which would like be the Four Seasons Hotel chain. Finally, you have a memorable, engaging patient experience. That is one that we can probably all strive for. This can be price, convenience, technology, service or experience. Your job is to pick one of those and then build your brand around the one that you choose.

It becomes about differentiating in your own individual market. Some of this relates to knowing what your competitors are doing and differentiating your practice based on what you know about your competitors. To give you little bit of insight here, it is very difficult to differentiate on price, because that is easily matched and very quickly becomes a race to the bottom. It is very difficult to differentiate on skill, because in the mind of the consumer, as long as you have a clean office and you have some certificates or diplomas hanging up, you are perceived as being professional and knowing what you are doing.

It is difficult these days to compete on technology. In the digital era where we all live, customers expect that technology will be incrementally evolving and also lowering in cost. Leaving a memorable experience is one good differentiation strategy because it is something that is very difficult for others to duplicate. You gain brand status by having a unique way of connecting with your marketplace. That comes into play not only with strategy, but also with design and how you create a memorable experience.

To give you more insight into why you might want to choose memorable experience as your differentiator, you can look at an economic model called the progression of economic value. There are a couple different axes that we can evaluate. On the horizontal axis, we have market value. Market value can go from low, which means customers do not think it is interesting or important, all the way to very high market value, where it is very unique and patients may be willing to pay more. On the vertical axis, you can look at the diversity of your offering, with undifferentiated offerings at the bottom and unique and different up at the top. Then on the opposite vertical axis, you have customer need, which ranges from generic or very ordinary up to very specific.

We can look at the progression about economic value through the lens of coffee, for example. We know if you wanted to brew a cup of coffee 100 years ago, you had to buy the beans in a mercantile. You probably had to grind them. You might even have had to roast them, and that was a very labor-intensive process. It was very much a commodity item. Then Folgers, Maxwell House and other companies got the brilliant idea to vacuum seal coffee into a bag or into a tin, and that created some differentiation, which added more market value. A certain segment of customers were willing to pay a little bit more for the added convenience of buying coffee at the grocery store that was already roasted and ground.

Then around that same time, restaurants got the brilliant idea that they could serve a bottomless cup of coffee with breakfast. That added a little bit of value and uniqueness, and they were able to charge a little bit more. Finally, 20 or so years ago, companies like Starbucks tried to re-create the Italian bistro experience and were able to differentiate themselves even more by offering that unique experience. When they did that, they were offering a very specific need to a specific segment of the customer base. Not everyone wants or desires that type of coffee, but for those that do, they are willing to pay a premium for that experience. That is the generic version of the progression of economic value.

Many different goods and services can be looked at through the lens of this progression- even the hearing aid industry. You can see the progression in Figure 1. At the bottom, we have an over-the-counter product or something that comes direct to the consumer; that is pretty much a commodity item. You go somewhere else and have that hearing aid programmed, and that becomes a good and adds a little bit of uniqueness and differentiation. Then, you provide a clinical service, which is a little more unique and differentiated. But if you take your ordinary clinical service, which is offered by many people, and you wrap a memorable, engaging experience through your design process around it, you can create more differentiation and more uniqueness for a certain segment of the market. That is how the progression of economic value looks in our industry. As we talk about strategy over the next few minutes, you probably want to aim near the top, where you are providing a memorable patient experience on top of excellent clinical services.

Figure 1. Progression of economic value as it relates to the hearing industry.

Who Wants or Needs your Brand?

The next question I want us to think about is, “Who wants or needs our brand?” Let’s say that we have decided to brand ourselves as a provider of a unique, personal, individualized experience. What part of the market wants that? Is at all people with hearing loss? Is it only people with a certain degree of hearing loss or with a certain need? Those are some of the core questions. That gets at the concept of segmentation. Segmentation is something that most businesses know is very important; I would say all of us are in a business, even if you work in a clinic or hospital. It is important to think about segmentation. Some of the questions you might want to ask yourself around segmentation are, “What part of the market are we trying to attract,” and, “How are various segments of the market unique?” Segmenting is about a subgroup of patients or customers who need your services and want your offering.

Segmentation

I want to differentiate and contrast segment versus channel. A segment is what part of the customer base wants or desires your offering, and a channel is how they will purchase your offering. That will make little bit more sense as we move along.

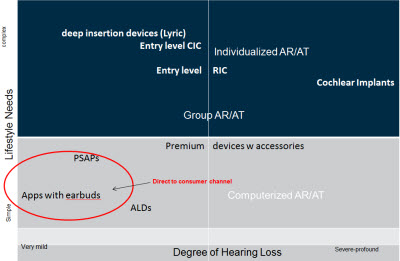

Traditional ways that we could segment for our services, which are hearing care and the fitting of devices, would be by age: pediatric versus young adult versus geriatric. We could certainly segment by income: affluent versus low-income versus middle-class. We know that that has some influence on how people approach the market. We could certainly segment based on performance characteristics of the services that we offer and the cosmetic requirements of our patients. We could even do some type of a matrix approach where we have performance on the horizontal axis from uncomplicated to dynamic and complex performance requirements. On the y-axis, we have cosmetics, which would be large hearing aids at the bottom and invisible or near-invisible hearing aids as we move towards the top. It might look something like what you see in Figure 2. This is where getting your team together and putting things out on a grid can make all the difference, because everyone's opinion on where it fits on the grid might be somewhat different. This is the very traditional device-centric way of segmenting. While there is nothing wrong with it, I think we are missing some opportunities when we narrowly try to define segments like what I have shown. We will get into some different ways of doing that in a moment.

Figure 2. Example of traditional segmentation based on cosmetics and performance in a matrix grid.

Channels

Let’s look briefly at some of the different channels where patients can get hearing care services. I have four main ones: direct-to-consumer, online with a service contract, retail (storefront) and medical. Each of those four channels requires a different design and strategy. I want to transition from the big-picture concept of strategy, channel and differentiation and progression of economic value and now look more closely at how you can devise your own strategy using some of this information I have provided. It is worth pointing out that this comes down to asking yourself the right questions, brainstorming, and implementing a specific strategy with your staff.

I want you to imagine all the patients within your own practice and all the opportunities within an average 30-minute commute of your office. This is how you get the idea of a footprint for your office. How many possible prospects are there for your services within a 30-minute commute? How many hearing-impaired individuals are there within that geographic footprint?

One way to answer that question would be to look at some prevalence data. A lot of this data I will share today comes from the Better Hearing Institute Web site (betterhearing.org) and also from Dr. Frank Lin and colleagues (2011) at John Hopkins. You would look at prevalence data to determine what segment of the market you want to tap. Here is a good one: almost two-thirds of adults over the age of 70 or older have mild hearing loss or worse. That might be something that plays into our strategy. Do we want to go after patients that are over the age of 70? Do we want to go after baby boomers? Do we want to look at a pediatric business model? The number of patients that are available in each one of those channels plays an important role in the strategy that we want to devise. A strategy that goes after two-thirds of patients over the age of 70 is a lot different than a strategy that goes after patients that are in the baby boomer range because there are far more individuals over the age of 70. That plays not only a role in the strategy that we are going to talk about, but on the design of the clinic as well.

What Jobs do Patients Want us to Perform?

I talked about what I called device-centric segmentation, and what I want to do next is talk about a broader, deeper way of looking at segmentation. As a part of our strategy, we have to not only look at the degree of hearing loss, but also ask ourselves, “What jobs do patients want us to perform?” By asking this question, I think we can uncover opportunities when it comes to devising a clear choice of strategies. We could look at different data points of different segments of the hearing aid market based on perceived hearing loss. One that I think is useful comes from Kochkin and Bentler (2010). This looks at a patient’s degree of hearing loss based on a quick hearing questionnaire. If you segment the market on hearing loss, about 25% of the market has a mild hearing loss, 33% has moderate and 43% has severe. I would suggest looking at market segments based on the degree of hearing loss.

One of the assumptions you can probably make is that someone with a mild hearing loss or near-normal hearing loss might buy through a different channel than someone that has a moderately-severe or severe to profound hearing loss. The question you want to ask is if all three of these market segments require different jobs from you. For example, very few of the near-normal to mild segment, which is more than 25% of the total hearing-impaired market, buy traditional devices or services from us. This segment of the market is probably very amenable to some type of an over-the-counter or direct-to-consumer channel. This is where we have to think if this is a segment of the market that we want to go after. Do we want to play in this pool?

Maybe there are some lessons that we can take from the optical market. For example, I have some data that was collected by Amlani (2013) and presented at Audiology NOW 2013. In talking to the Vision Council, he found that of those that purchased a pair of over-the-counter readers, 20% to 25% purchased a complete set of glasses, contact lenses, or underwent Lasix surgery within 18 months. That might mean for us that there is a certain segment of this market who may be more amenable to an over-the-counter solution that eventually migrates to more comprehensive services that we develop within an 18-month period of time. This is something worth thinking about.

I would say that the mild to moderately-severe segment is our more traditional segment. These are the patients that want customizable devices. If you are trying to go after this segment, then the design of your clinic needs to be one that makes it comfortable for those that want a customized solution. Lastly, the severe-to-profound segment accounts for probably 5% to 10% of the hearing-impaired market. This is the one segment that would buy through the traditional medical channel, which typically involves an ear, nose, throat physician (ENT).

If we made a graph for segmentation, the degree of hearing loss would go on our horizontal axis, and the job that the patient requires us to do would go on the vertical axis. The question is, “What jobs do patients with hearing loss want us to perform?” Some of the answers you have to uncover would be, “Help me…; Provide me…; Enable me…; Get me...” I will explain what I mean in a minute.

An example of an industry that does an excellent job of segmentation based on jobs that customers want them to do would be grocery stores. Peapod has a completely different strategy compared to a high-end grocery store. The high-end grocery store here in Minnesota is Byerly’s. Byerly’s has built their strategy by developing convenient, ready-made meals. The customer might say, “Help me put a meal on the table tonight without any planning or preparation. I want to go in to the store and buy it.” Byerly’s has created a business model around the job that customers want them to do. Peapod has also built a strategy and is going after segment of the market that wants convenience. “Provide me with a service that allows me to do all my grocery shopping from home and you deliver it to me.” That is a good example of the use of segmentation and building a strategy around the job that a customer wants you to do.

I would say that we can do a similar thing with hearing care. For example, what is the job that patients with near-normal or mild hearing loss want us to do? Some of those things might include allowing them to turn the TV volume lower, hear on the telephone or follow a conversation in a noisy restaurant. Generally, these are relatively isolated or finite problems that they need us to fix. That is the job that is required of us.

For the mild to moderately-severe segment, it becomes a bit more complex. We have to not only help the person hear in a variety of complicated and dynamic listening situations, but we may need to be involved with coping strategies and helping the patient adjust to the long-term effects of social isolation. We may have to help them maintain their independence and their sense of youth, and we might have to help them optimize the functionality of their devices. The jobs that mild to moderately-severe hearing-impaired patients expect of us are far more complex than the near-normal and mild segment.

Here are the different channels through which our hearing-impaired patients can obtain their services. For near-normal to mild, it may be better for them to obtain those specific services online or direct-to-consumer. Mild to moderate would be retail or medical, and severe to profound would be more of the medical channel. Here is how my segmentation grid looks (Figure 3) when I put the degree of hearing loss on the horizontal axis and lifestyle or jobs that the patient needs us to do on the vertical axis. You will notice that it opens up the some of the other possibilities of what we do. Not only do I have the fitting of certain devices on here, but I also now know that auditory rehab and auditory training become an important job that some customers may require of us. On the left side of the quadrants, I have what I think are most amenable to the direct-to-consumer segment. That is a fairly significant part of the potential market.

Figure 3. Segmentation matrix using degree of hearing loss and lifestyle needs

Defining your Strategy

I want to give you some questions that you can ask yourself to define, devise, and develop your own strategy. The first thing I want to say about your own strategy is that hoping patients find out about your office and seek your services is certainly not a strategy. Unfortunately, that is what many practices often do. A strategy is a specific plan of action that is based upon data, segmentation data, channel data, and prevalence data that you use to build a sustainable business. A strategy targets a specific segment of the market within a certain channel, and it offers a precise job or product that customers are asking us to provide them. On the other end of things, it also allows for you to be profitable over a period of time. We have to make sure that we factor that into the equation.

Why is a strategy needed? Simply put, you cannot be all things to all people. In order to optimize your time, which for most of us is our most precious resource, you need to go after specific segments of the market with a specific offering. If we boil it all down to the ridiculous, there are only two possible strategies that we can use. There is a low-price strategy and a differentiation strategy. I think for most of us, the only choice we have is a differentiation strategy. I would make my differentiation strategy based on the ability to provide a memorable, remarkable patient experience.

Here are some key questions to ask yourself. The first question when you are developing your own strategy is, “What is your mission and purpose within your business?” The following is an example of a practice’s mission and purpose: To translate idealism into action by putting the needs of adults with hearing loss before all else. That is a very lofty mission and purpose, but that gives you a stake in the ground defining what your business is about. It is a value type of statement. A good tip when you are trying to develop your mission and purpose is to make sure that it reflects your own personal values and how you want to run your department or practice.

The next question is, “In what part of the market do you want to play?” An example statement of this that goes right to the heart of segmentation data is, “We are going to provide comprehensive services to adults with hearing loss with conventional hearing instruments, and we are going to offer rehab services.” That would be example of the segment of the market in which this practice wants to play. You can go back to that segmentation grid (Figure 3) using some prevalence data and knowledge of the competition to help devise your own answer to this question.

The next question is, “How will we win?” which translates to how we are going to beat the competition with our strategy. Is it going to be a low-cost strategy or is it going to be a differentiation strategy? I have already mentioned that I think the only choice in our profession these days is to have a differentiation strategy. It is difficult to have a winning strategy revolving around low cost based on the type of service that we provide.

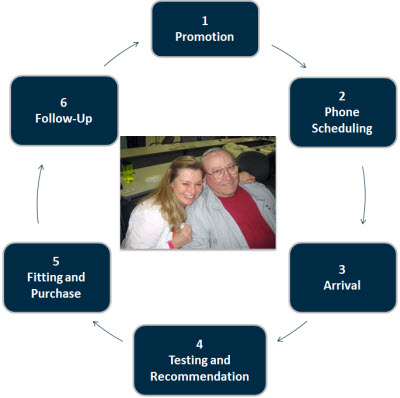

The next question is, “What capabilities must we have in place to successfully differentiate our strategy?” This gets at what we do in the clinic to make sure that patients feel and perceive the value of what we are doing. Answers to this question include things like motivational interviewing techniques, making an engaging patient experience centered around six staging areas, and offerings that can be duplicated by technology or your competitors. Your ability to execute speech mapping or speech-in-noise testing are both possible components to this question.

Figure 4 illustrates an example of the six staging areas. Make sure that you have a sequence of events around these six key patient staging areas within your practice. I think that forms the foundation your strategy and your design, as we will talk about in a moment.

Figure 4. Patient experience using six staging areas.

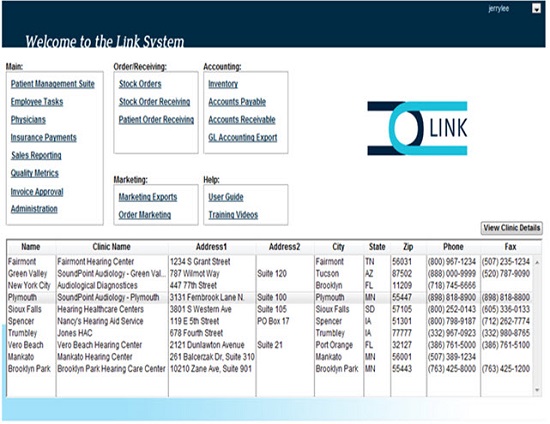

Finally, the last question about strategy that takes a little work on your part to answer is, “What systems are required to support our strategy?” The answer to that question is probably going to be some type of a robust office management system that is able to pull out real-time key performance indicators so that you can make data-driven decisions about your practice, to pull out quality metrics around returns and relative patient benefit and satisfaction, and to make patient data-driven decisions about how you are going to run your practice. It might also provide variable data printing, which is a somewhat technical term that describes your ability to send out communications like newsletters to certain segments of your database on a monthly basis. Then, if you are in a medical practice, it might be the ability to send information to the electronic medical records of the ENT division of the practice. Those are some of the key components of a robust system that allow you to execute your strategy. Figure 5 is a screenshot of a system called ULink. It does all of the tasks that I just mentioned. This is an office management system that is now on the market.

Figure 5. Screen shot of office software ULink.

Pricing Strategies

The next thing that I want to talk about is how you price your products. If you talk to economists, they will tell you that price is nothing more than a signal to the market about what your strategy is. It is important that we put a little thought into pricing strategies and how we are going to signal our offerings to a specific segment of the market.

To give you little bit of background, there are only three pricing strategies that are available for you to use. The first two are more or less the same thing, which are a simple markup and a margin-based strategy. Those are typically when you take the wholesale cost of goods and you multiply it by a certain number to get your retail cost. Margin-based pricing is a bit more sophisticated. You have to look at your margin and determine what percentage you need to maintain a certain amount of profit or cover your costs. The third strategy, and the one that we probably should be looking at, is using a value-based price strategy. It is beyond the scope of this one-hour webinar, but I wanted to talk about how you can use a value-based pricing strategy to signal your unique offerings to the marketplace.

Itemized Bundling

I am going to talk about itemized bundling. It is a hybrid approach that takes the best of unbundling and bundling to provide a signal to the market that you are about a high quality of service. In an itemized bundling approach or value-based price strategy, the first thing you want to do is tier your products or devices based on level of sophistication. The Unitron line, as an example, goes from the entry-level E product up through the Pro, which is the premium product. The next thing that you want to do is define your entry-level offering.

Another question you want to ask yourself is, “What is the minimum level of service and technology that I am willing to dispense to my patient base?” You have to formulate your own answer to that question, but I will provide one example of a practice’s entry-level tier of service. This might include the diagnostic evaluation, which could be unbundled and coded properly, a pair of devices, one year of follow-up office visits, a group aural rehabilitation class, and a one-year loss and damage and repair warranty. For this example practice, this is the minimum level of service that they are willing to offer their patient base.

The next task in an itemized bundling approach would be to list the additional features and benefits that you could add to your entry-level bundle. The following is a list of some of the other possible services, devices, or products that you could offer patients that might be of value: remote control, earmolds, companion microphone, wireless accessories, dry-and-store kit, warranty, additional batteries, aural rehab services and unlimited service visits.

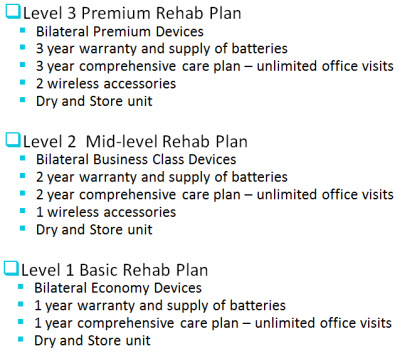

The next step would be to present itemized bundles to the patients. This is the actual signal to the market about what your office is offering. There are two different ways that you can present itemized bundles to your patient base. The first way is called versioning. In a versioning approach, you lock in the different choices at various price points. In my example, there are three different levels (Figure 6). We are offering these as a rehab plan and not centering them on a device. In the level 3 premium rehab plan, (which I would encourage you to rename), you have a bundle of services that are locked in at that price point. For level 3, you have a longer warranty, two wireless accessories, and a dry-and-store unit. For level 2, you have a step down in technology from premium to business class, so you lessen the warranty, and you offer one accessory instead of two. Finally, for your third and entry-level rehab plan, you have bundled together two economy level devices, one year of services and a dry-and-store unit at that price point. In my experience doing this, a practice is best served if they have either three or four itemized bundles that they can offer their patients. In a versioning approach, the choices are locked in by the practice at specific price points.

Figure 6. Example of versioning with three bundle choices.

Pick-a-Plan

You can contrast that to a different type of itemized bundling approach which is called Pick-a-Plan. In a Pick-a-Plan approach, the patient can choose the extra value add-ons at different price points. In the Pick-a-Plan approach, the provider would furnish the customer with a list of choices and they would choose from that list. In my example of a Pick-a-Plan at the premium rehab level 3, the patient could choose up to three accessories or perks off of a menu of choices. Of course, the provider could guide them towards their choices, but in this approach, the patient is given a little bit more flexibility. When you move from level 3 to level 2, the number of perks they can choose goes down by one, and when you move from level 2 to level 1 the number of perks and the technology level goes down. We are signaling to the market that the offerings are not device-centric, but rather rehab-centric, which is what differentiates our services from direct-to-consumer and from other low-cost competitors. This is the way that you would signal that strategy to the marketplace.

Design

I wanted to take the last few minutes to touch on design, because design, like price, is your interface and the way that the market perceives you. A big part of design is simply the workflow and the way the office looks. There are some genuine opportunities here to differentiate yourself on the upward side of that progression equation that I showed you earlier (Figure 1). As I mentioned, design is the outward display of your practice. Careful design will capture the attention of patients. It defines your brand in the eyes of the consumer. In light of all of the disruptive innovations that are on the horizon, design is an opportunity to make your practice a destination place. If you think back to the old TV show Cheers, it is a place where everybody knows your name. That is a nice way to think about your practices being a destination place- a place where people want to spend a little bit of time. One consideration when you are designing your clinic is to make it functional for the staff so they can work efficiently, but you also want to make it inviting to the patients, which goes without saying.

One of the more interesting things happening in healthcare now is the design of clinic space at Mayo Clinic in Rochester, Minnesota. Mayo Clinic calls these “Jack-and-Jill” rooms (Figure 7). You can watch a 2-minute video that goes into some of the considerations of their Jack-and-Jill rooms (https://www.youtube.com/watch?v=Yw5TBjyefog). They have taken the traditional exam room, which is uncomfortable and impersonal for a patient with all the medical equipment, and they have designed a much more patient-friendly space where they can go in and spend time with the physician or the nurse right next to it. Not only do they have very comfortable chairs, but it is lit in a different way. They have large-screen monitors. They have taken that design concept and put that into action at Mayo Clinic.

Figure 7. Jack-and-Jill treatment rooms at Mayo Clinic, Rochester.

When you are designing your own clinic space and trying to make it a destination point for your patients, it is important to involve all five senses; that is what makes it that emotional experience that people are willing to talk about- using audio, visual and touch in the experience.

Theme

You also want to make sure that your design centers on a theme, and the theme, knowingly or not, for most practices looks like this (Figure 8). Like it or not, every practice does have a theme, and some themes are more memorable than others.

Figure 8. Medical office waiting area.

The theme of medical practices is typically very sterile and ordinary. However, there are all kinds of opportunities to tailor your theme along the lines of Dr. Paula Schwartz's office here in Minnesota (Figure 9). It looks very much like being in someone's home- a very comfortable nurturing environment.

Figure 9. Example of inviting and comfortable waiting area.

When designing your practice around a theme, remember that a theme should not only be interesting to you and your staff, but a theme should be uplifting and positive for your patients. It should involve all the senses whenever possible, and it should be something that is very captivating upon entering your clinic. It should be obvious and intuitive. Remember that a theme is an organizing principle that guides the behavior of you and your staff, and it influences the patient experience around those six staging areas that I showed you previously (Figure 4). Like it or not, every practice does have a theme. Hopefully yours is more memorable than others.

I wanted to give you one brief example of theme in a practice. Harold Peeno is a hearing instrument professional in Florida. His practice is in Lake Worth, which is a Bohemian community with a lot of artists. You will notice that the practice's name is House of Hearing (Figure 10). It looks like an art house movie theater. Because it is an artistic community, he has woven that concept into the theme of this practice. You will also notice that there are coffee-table art books. When you are in Harold's office, it almost feels like you are in an art gallery. You will notice more art on the wall and pottery. He has centered his theme around something that is very important to the community, which is art, and it feels like an art gallery when you are in his office. He has used that as the unifying concept to attract a certain segment of the market in his footprint.

Figure 10. Exampled of a well-themed practice, House of Hearing in Florida. From top to bottom: exterior sign, front entrance, reception, hallway, office space.

Summary

When it comes to devising your own strategy, there are two fundamental ways that you can capture more of the market: to be a low-cost leader or to have a differentiation strategy. I hope I made it clear that in the face of direct-to-consumer online sales, the only choice that we have these days is to pursue a differentiation strategy. A big part of devising your own strategy is to look at segmentation data. You can look at not only the jobs that patients require us to do, but also look at the degree of hearing loss when you are segmenting your market. You want to make sure that you are trying to win or capture business from a specific segment of the market, because we cannot be all things to all people. An important part of your final strategy in the execution stage would be to make sure that you create prices and offerings that signal your strategy to a specific segment of the market.

When you are customizing or devising a strategy, these are the five questions that you have to hash out very carefully with your staff: What is your mission and purpose? Where will you play? How will you win? What capabilities are needed to be successful? What systems are needed? Those are the five key questions that only your practice can hash out on an individual basis.

An important part of strategy is the design or the outward face of your clinic. One differentiation strategy involved in the design process is making sure that you optimize the shared decision-making process like Mayo Clinic has done with their Jack-and-Jill rooms. Stage the patient experience around six areas. Lastly, ensure that there is a theme woven throughout your practice that is both engaging and memorable that makes your practice a destination point for a specific segment of the market.

If you want more information on how to customize these concepts, you can certainly contact me (Brian.Taylor@unitron.com).

Questions and Answers

How can I use the segment strategy in a bilingual population?

I think the obvious way would be for you to devise a strategy around trying to attract only one of the languages, which you probably do not want to do, but I would say you can use the same techniques that I did. You could segment based on degree of hearing loss and the jobs that patients require you to do. Those are the two main axes when developing your strategy. For both of those axes, you move from simple to complex or mild to profound. I do not think it matters so much about the language, as long you have the capabilities to address them.

References

Amlani, A. (2013, April). Improving hearing aid adoption rates through smartphone applications. Paper session presented at Audiology NOW!, Anaheim, CA.

Christensen, C. (2008). The innovators prescription: A disruptive solution for healthcare. New York, NY: McGraw-Hill.

Godin, S. (2003). Purple cow: transform your business by being remarkable. New York, NY: Portfolio.

Kochkin, S. & Bentler, R. (2010). The validity and reliability of the BHI Quick Hearing Check. Hearing Review, 17(12), 12 - 28.

Lin, F. R., Niparko, J.K., & Ferrucci, L. (2011). Hearing loss prevalence in the United States. Archives of Internal Medicine, 171(20),1851-1853. doi:10.1001/archinternmed.2011.506

Topol, E. (2012). The creative destruction of medicine: how the digital revolution will create better healthcare. New York, NY: Basic Books.

Wallhagen, M. I. (2009). The stigma of hearing loss. The Gerontologist, 50(1), 66-75. doi: 10.1093/geront/gnp107

Cite this content as:

Taylor, B. (2013, August). Strategy and design in your audiology clinic. AudiologyOnline, Article #11967. Retrieved from: https://www.audiologyonline.com/